I was asked this question a while ago by a former colleague who is opt to fly and practice here as a nurse.

To tell you the truth I only have $100 in my pocket given by my cousin when I flew here. My agency paid for everything, thanks to them I was able to come here.

I applied through ABBA and their partner agency here in the US is Vintage Health Services.

They reimbursed our NCLEX, IELTS, review for both, plane tickets, downpayment for our cars, helped us acquire driving license and money to be able to start here but before you sign any contract on any agency please read the fine prints and tell yourself you will try your best to finish the deal. Whether it is in hours or years.

What if you are directly hired, meaning the hospital probably helped process your papers before coming here or your agency doesn’t offer the same benefits, how much pocket money should you have in the current market situation?

What you need:

Housing.

Hotel for the first few months or days then an apartment to stay in.

The average hotel is around $60-100/day plus taxes. You can opt for an Airbnb but it will usually have cleaning fees additional. Let’s say you will stay there for a month prior to being able to find a decent apartment.

1 night $60

Taxes and fees $11

=$71×30 = $2,130

You can also check Airbnb or Fully furnished but do not put deposits until you see the place, some of them can really be cheap but only because they are situated in the sketchy areas of the neighborhood.

Apartments cost depends on the place you are in. The highest is around California, New York, and Chicago. In most states, you can find a decent apartment for $800-$1500. They will ask for a downpayment equivalent to a month’s rent and do a background check on you. Avoid areas that are too cheap within the price range of the state, like Airbnb it’s mostly because they are in the unsafe areas of the neighborhood or because you have to shoulder a lot of extra expenses like utilities, sewage, AC, heating, and water. Or worse moldy walls, and leaking ceilings. Some apartments would also warrant you to buy a washer and dryer, a used one can cost $500-800 and a new one over $1k.

Alocate money for furnitures, we advice not to buy a lot specially if you’re aiming to transfer to your family on another state. It’s easier and more practical.

Don’t forget the internet $79-$100.

Transportation

If you are in the big cities like New York and Chicago public transport will do but if it’s in the other areas you absolutely will need a car. There are buses and trains but it is safer and more convenient if you have a car.

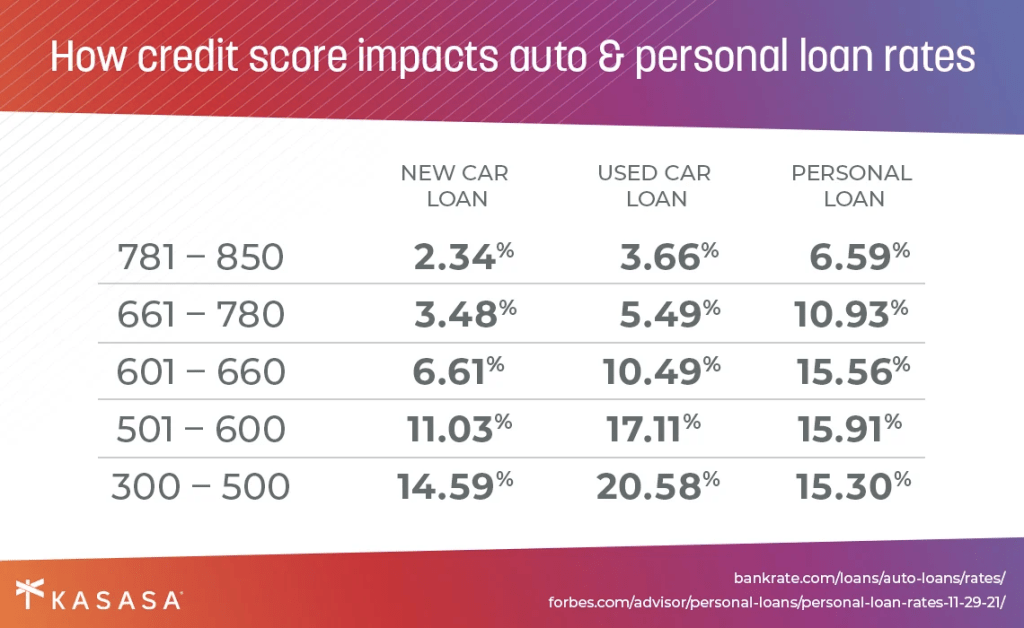

Typical brand new sedan costs around $20k and an SUV around $25k depending on the make and model of the car. Usually, they ask for a 20% downpayment which is $4k but if you are new, you won’t have a credit score and they will not give you any loans. So in the first 6 months you may ought to get a credit card and build your credit. Credit unions charge the least interest, the lesser your credit score the higher the annual interest is:

You can buy a raggedy old car for as low as $6k-$8k but expect to pay $2-$3k on repairs for the first 2 years of owning it.

You can buy a dependable car around 5-10 years old for $15k-$18k.

For the first 6 months, you might need to use Grab/Uber. Bus rides are way cheaper but sometimes not as safe depending on where you live. And it will be harder during winter.

Necessities

Grocery and necessities, $100/week is good enough but if you are real thrifty it could be less, also consider your health. Eat good food.

Phone and phone plan

You have to unlock your phone if you wanted to use it here. Phone plans can range from $15 to $100/ mos depending if you are getting a new phone alongside the services it provides.

Miscellaneous

Extra for miscellaneous like car and apartment insurance. It is a must to get insurance for both car and apartment, this can be paid on a monthly basis. It will be cheaper if you pay for it for the whole year or the next 6 mos months. For old cars, it can cost around $50/month but for new cars around $100 depending on the insurance provider and coverage. Apartment insurance cost is around $100-$200 per year depending on the area you are living.

Extra few bucks just in case you break a plate or need to pay for small fees like processing your driver’s license.

These are just estimates you may spend 10-20% less or more but atleast you have some grasp on how much.

God Bless!

Leave a comment